Hello, I'm Ronald Díaz

I’m a Senior Financial & Accounting Analyst with over 6 years of experience in audit, financial reporting, and data analysis. I specialize in identifying opportunities to optimize performance through smart data use and strategic insights.

I'm an Accountant!

Hi, I’m Ronald Díaz, a detail-oriented and results-driven professional with a strong background in accounting, auditing, and data analysis. I’ve worked with leading audit firms, managing teams and reviewing financial information to ensure accuracy and compliance. I’m passionate about transforming financial data into strategic insights that drive growth and efficiency. Currently, I’m expanding my skillset in Python, SQL, and financial modeling to deliver even greater value through automation and smarter decision-making.

Services

As a Senior Financial & Accounting Analyst, I transform complex financial data into clear and valuable insights. My goal is to support informed decision-making, drive performance, and improve efficiency. I’ve worked on a wide range of projects including financial audits, variance analysis, budgeting, forecasting, and process automation. My approach is highly hands-on, and I take ownership from start to finish with a focus on delivering strategic value.

Financial Modeling & Automation

I build dynamic financial models and automate repetitive tasks to increase accuracy and save time in forecasting, budgeting, and reporting.

Tools I use: Python, SQL, Excel Macros, Alteryx

Performance Dashboards

I design dashboards that help managers monitor KPIs and make faster decisions. Clear visuals, custom filters, and actionable indicators.

Tools I use: Power BI, Tableau, Excel

Process Optimization & Analytics

I streamline financial processes and integrate data workflows to reduce manual effort, improve accuracy, and speed up decision-making in budgeting and forecasting.

Tools I use: Python, SQL, Excel Macros, Alteryx

Financial Reporting & Audit

I ensure compliance, clarity, and reliability in financial reporting. With over 6 years in audit firms, I’ve led teams reviewing statements, controls, and accounting policies.

Tools I use: Excel, SAP, Siesa, IFRS Standards

Portfolio

Monte Carlo Simulation for a Sugarcane Investment Project

Objective

The goal of this Monte Carlo simulation model is to evaluate the financial viability of a sugarcane cultivation investment project under uncertainty. By incorporating probabilistic assumptions for key input variables—such as inflation, local and international sugar prices, exchange rate (TRM), and cost volatility—the model allows stakeholders to better understand the range of possible Net Present Value (NPV) and Internal Rate of Return (IRR) outcomes

Context of the Case

A Colombian agribusiness company was evaluating the feasibility of investing in 1,000 hectares of sugarcane cultivation. The decision required a robust financial model to analyze the project’s profitability under uncertainty. While a deterministic Excel model had already been built, it provided only one static outcome, failing to reflect the risks and variability inherent in key drivers such as:

- Sugarcane yield per hectare

- Sucrose content

- Selling prices (local and export)

- Foreign exchange rate (TRM)

- Inflation rates

Input Excel: Download

To address this, I developed a Monte Carlo simulation tool in Python, fully integrated with the existing Excel model. This allowed the company to:

- Quantify the risk of negative returns

- Visualize thousands of future scenarios

- Make more informed decisions based on a range of financial outcomes

The simulation was designed to be run directly from Excel via a button, allowing non-technical users to run it repeatedly, update inputs, and understand the risk profile without modifying the formulas or breaking the model.

Python Code: Download

Understanding

The simulation was implemented in Excel, enhanced with VBA and xlwings in Python to enable automation and dynamic reporting. A total of 10,000 iterations were executed, using historical data to define probability distributions for each input. The model generates key financial metrics (NPV and IRR) and visualizes the results using a histogram with KDE (Kernel Density Estimation), rug plot, and median line. The interface also includes interactive buttons for running simulations and resetting inputs.

Technology Stack

Python using Jupyter Notebook

xlwings – for reading/writing Excel files and triggering Excel calculations.

Matplotlib & Seaborn – for statistical visualizations.

Microsoft Excel – for the deterministic model structure and calculations

Macro:

Conclusion

The results show a mean NPV of $7.54 billion COP and median NPV of $7.48 billion COP, with a 0.5% probability of loss based on 10,000 simulations. The IRR is equal to 31%, significantly above the cost of equity (10.5%). These results suggest the investment project is highly attractive and resilient to the simulated variations in key assumptions.

Anomaly Detection in Journal Entries with an Autoencoder

Objective

Prioritize unusual journal entries without hard-coded rules, so auditors focus on a small, high-risk subset while maintaining coverage..

Context

Industry: Personal-care manufacturing (Colombia)

Period: Fiscal year 2024

Volume: 39,681 journal entries (~100k rows)

Why this approach: Rule lists and manual filters miss novel patterns and are costly to maintain. An unsupervised method learns normal behavior and highlights what doesn’t fit.

Data

Per-line fields

Document number, Posting date, User SAP, Document type, Transaction type, GL account (Colombian PUC 6 digits), Account name, Debit, Credit, Amount (= Debit − Credit).

Structure

Entries have 2–6 lines and typically balance to zero.

Governance

PUC catalog (6 digits), user roles with segregation of duties, coherent document types, and accounting controls (e.g., Sales→A/R; Purchases/Expenses/Fixed Assets→A/P; Adjustments never touch banks; petty cash is 110510).

Data_Base: Download

Business understanding & controls (normal behavior)

Sales (VT): must hit 112005 Accounts Receivable; collections via RC.

Purchases / Expenses / Fixed assets (CP/GO/AF): must hit 210505 Accounts Payable; payments via PP (CE).

Adjustments (AJ): do not touch bank or client accounts.

Petty cash: 110510 (not 111005).

Segregation of duties: Purchasing=FC; Treasury=RC/CE/ND; Accounting=NC; Payroll=NE.

Validation ground truth (controlled fraud)

Purpose: a small, realistic benchmark to check whether an unsupervised model surfaces real risks.

Volume: 25 entries dispersed among 39,681 documents.

Examples: Sales without A/R; CP/GO/AF without A/P or posted directly to banks; Adjustments hitting bank accounts; petty cash using 111005; invalid document↔transaction pairings; role violations.

Label handling:

Fraud/Fraud_reasonremoved before training and used only for post-hoc evaluation.

journal_entries_Label _FraudFraud_reason: Descargar

Methodology

Feature engineering (document-level)

Aggregations per Document number capture the logic of the whole entry:

- Amounts: sum_debit, sum_credit, absolute net_amount, avg_line_abs, n_lines, n_gl_unique.

- Categoricals: user_sap, document_type, transaction_type, month, weekday.

- Accounting signals: flags for key GLs (111005, 112005, 210505, 110510, 410505, 510505, 150405, 220505, 240805/240815, 143005, 520505, 159205) and PUC class proportions (1–7).

- Preprocessing: One-Hot (categoricals) + StandardScaler (numericals).

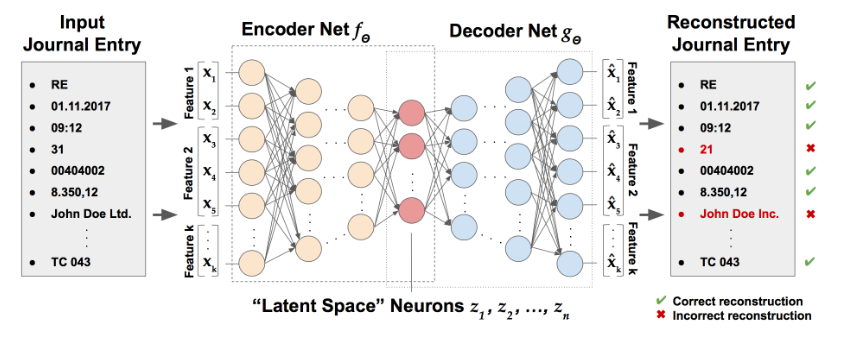

Model (autoencoder)

Architecture: 64 → 32 → 8 (bottleneck) → 32 → 64 with BatchNorm, Dropout, L2; loss = MSE.

Training: 80/20 split, early stopping.

Threshold: 99.5th percentile of reconstruction error (MSE). Above threshold = suspicious.

What “reconstruction” means

The network learns what a normal entry looks like.

It compresses each entry into a compact 8-neuron memory.

It rebuilds the entry from that memory.

The difference between input and rebuilt version is the reconstruction error.

Low error: looks normal.

High error: unusual mix (e.g., Sales without A/R) → prioritize for review.

Analogy: a copier trained with normal entries; odd documents come out “blurry” where the oddities are.

Results

Highlights

199 entries flagged (~0.5% of 39,681).

25/25 controlled frauds ranked in the Top-25 by score (perfect recall on planted cases).

Common patterns flagged: duty-segregation violations; Sales without A/R; CP/GO/AF without A/P; Adjustments touching banks; non-zero net totals.

Doc_Scores: Download

Technology used

Python, TensorFlow/Keras, scikit-learn, pandas, NumPy, openpyxl.

Versioned artifacts: preprocessor (

.pkl), model weights (.h5), threshold (.txt).Outputs:

Doc_Scores.xlsx,Journal Entries Etiquetado.xlsx.

Professional Experience